Tariffs stay: FTSE reacts after Trump’s 90-day climbdown however China hits out at US ‘blackmail and bullying’

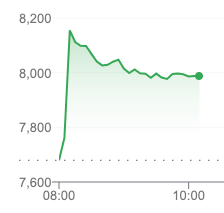

The UK’s FTSE 100 has surged higher as a relief rally washed over battered global stock markets, after Donald Trump announced a 90-day tariff pause for most countries.

The index soared by more than 6 per cent shortly after markets opened on Thursday, and was still around 4 per cent higher later in the morning.

European stocks were also rocketing today following a rebound for US and Asian markets.

The rebound comes after the US president made the shocking decision to implement a 90-day freeze on the hefty duties he had just imposed on dozens of countries.

However, Mr Trump ratcheted up the pressure on China, immediately hiking the tariff on Chinese imports to 125 per cent from the 104 per cent level that kicked in on Wednesday, as the trade war between the world’s top two economies continues to escalate.

Beijing slapped 84 per cent tariffs on US imports in return, and has now hinted at further counter-measures in response to the US’s “blackmail” and “bullying”.

All countries will still face what Mr Trump calls his “baseline” 10 per cent tariff, with the UK government saying it does not expect those to be paused.

ANALYSIS: What’s behind the sudden change of heart from Trump

The Independent’s business and money editor Karl Matchett reports:

Why the sudden change of heart from Trump yesterday then?

Bonds. US government debt, bought in the form of 10-year US Treasuries, plunged in value yesterday (which sends the yield, or amount payable on them in interest, up).

That raises long-term costs to the US public and is an impossibility to beat, basically. In the words of one Yahoo Finance analyst, the stock “markets were the initial indication that all was not well…but when the bond market began to turn, the game was up”.

Futures fall after sharp rally on Trump tariff reversal

US stock index futures fell on Thursday, a day after an eye-watering rally set off by Donald Trump’s move to temporarily lower the heavy tariffs on dozens of countries, while raising the levies on China.

The U-turn came less than 24 hours after steep new tariffs took effect on most trading partners, lifting the S&P 500 to its biggest single-day percentage gain since 2008. The Nasdaq posted its biggest one-day jump since 2001.

Despite Wednesday’s surge, the S&P 500 and the Dow are about 4 per cent below levels seen before the reciprocal tariffs were announced last week.

At 04.55am ET, Dow E-minis were down 658 points, or 1.61 per cent, S&P 500 E-minis were down 117.75 points, or 2.14 per cent and Nasdaq 100 E-minis were down 503.5 points, or 2.61 per cent.

Most megacap and growth stocks slid in premarket trade after recording stellar gains in the last session, with Tesla sliding 4.5 per cent and Nvidia down 3.8 per cent.

Investors will focus on March consumer prices data later in the day amid worries that Trump’s tariffs could hamper global growth and spur inflation.

Economists polled by Reuters expecting headline inflation to ease to 2.6 per cent from 2.8 per cent last month on a yearly basis.

“Risks are clearly tilted to the downside, and if the hit to growth is larger than we assume or the Treasury market stops functioning, a series of rate cuts and market interventions could follow,” Nordea analysts said.

Not all countries interested in linking up with China despite unhappiness with US

Despite their unhappiness with Washington, not all countries are interested in linking up with China, especially those with a history of disputes with Beijing.

“We speak for ourselves, and Australia’s position is that free and fair trade is a good thing,” Australian Prime Minister Anthony Albanese told reporters. “We engage with all countries, but we stand up for Australia’s national interest and we stand on our own two feet.”

China imposed a series of official and unofficial trade barriers against Australia in 2020 after the government angered Beijing by calling for an independent inquiry into the Covid-19 pandemic.

India has also reportedly turned down a Chinese call for cooperation, and Russia, typically seen as China’s closest geopolitical partner, has been left out of the Trump tariffs altogether.

Taiwanese foreign minister Lin Chia-lung said on Wednesday that his government is preparing for talks on tariffs with the US.

The US imposed a 32 per cent tariff on imports from Taiwan, a close trading and security partner.

Taiwan produces most of the high-performing computer chips craved by the US and others and has long enjoyed a trade surplus with Washington.

Yet, south-east Asian nations such as Vietnam and Cambodia find themselves in a particular bind.

They benefited when factories moved to their countries from China because of rising costs.

They are being hit by punishing tariffs but have few buyers outside the US and are already operating on razor-thin margins.

China reaches out to other nations in apparent attempt to form united front against US

China is reaching out to other nations as the US layers on more tariffs in what appears to be an attempt to form a united front to compel Washington to retreat.

Days into the effort, it is meeting only partial success with many countries unwilling to ally with the main target of President Donald Trump’s trade war.

China has thus far focused on Europe, with a phone call between Premier Li Qiang and European Commission President Ursula von der Leyen “sending a positive message to the outside world”.

“China is willing to work with the EU to jointly implement the important consensus reached by the leaders of China and the EU, strengthen communication and exchanges, and deepen China-EU trade, investment and industrial cooperation,” the official Xinhua News Agency reported.

That was followed by a video conference between Chinese commerce minister Wang Wentao and EU commissioner for Trade and Economic Security Maros Sefcovic on Tuesday to discuss the US “reciprocal tariffs”.

Mr Wang has also spoken with the 10-member Association of Southeast Asian Nations, while Mr Li, the premier, has met with business leaders.

China has “already made a full evaluation and is prepared to deal with all kinds of uncertainties, and will introduce incremental policies according to the needs of the situation”, Xinhua quoted Mr Li as saying.

UK’s FTSE 100 remains high as European stocks rocket up

The UK’s FTSE 100 has surged higher as a relief rally washed over global stock markets, after Donald Trump announced a 90-day tariff pause for most countries.

European stocks were also rocketing higher following a rebound for US and Asian markets.

The FTSE 100 soared by more than 6 per cent shortly after markets opened on Thursday, with Barclays leading the charge with gains of as much as 28 per cent before paring back to around 10 per cent.

The index was still around 4 per cent higher later in the morning.

Germany’s Dax index shot up about 5.9 per cent, and France’s Cac 40 was soaring around 5.4 per cent.

China and Hong Kong’s stocks close up on hopes of trade negotiations despite Trump’s tariff hike

China and Hong Kong shares ended higher on Thursday, as investors played down the latest US tariff increase on Chinese imports and pinned their hopes on talks between the world’s two largest economies as well as on market and policy support from state firms.

China’s blue-chip CSI300 Index closed 1.3 per cent higher, while the Shanghai Composite Index rose 1.2 per cent. Hong Kong’s benchmark Hang Seng was up 2.1 per cent.

The rise in Hong Kong shares followed a 6 per cent surge in Chinese internet companies listed on the US market overnight after Donald Trump temporarily cut the steep tariffs he had just imposed on dozens of other countries.

Trump at the same time escalated tariffs on China to 125 per cent from the 104 per cent level that just took effect on Wednesday.

“Even though it’s obvious that the tariffs are targeting China, there is still some room for manoeuvring and negotiations if they can pause tariffs on other countries,” said Jason Chan, senior investment strategist at Bank of East Asia.

“Markets still have some hope that at least some discussions could take place.”

Bond market fears ease as economist suggests US and Europe will avoid recession

A violent US treasury selloff on Wednesday that reignited fears of fragility in the world’s biggest bond market has also showed some signs of easing.

“With less burdensome extra tariffs and more clarity by mid-year, the US and Europe would suffer a temporary setback to economic growth but would be spared a recession,” said Berenberg economist Holger Schmieding.

Trump’s climbdown on tariffs ‘reinforces’ UK government’s approach, says Cooper

Donald Trump’s pause on tariffs “reinforces” the UK government’s approach to the issue, home secretary Yvette Cooper has said.

Asked on BBC Radio 4’s Today programme if the last 24 hours had put her off relying on the US as a trading partner, Ms Cooper said: “I think it just actually reinforces the strategy and the approach that we’re taking, which is to be pragmatic, to take this steady course rather than to get buffeted around from day to day or getting into the sort of running commentaries and reactions.”

She said there is a need to “continue with what we’re doing, which is firstly about the discussions we’re having with other countries”.

Ms Cooper said: “It is also about what we’re doing to support British industry and the British economy here in the UK, part of the plan for change the Government set out making sure we can get that investment, that we can be really a stable place for business investment to come to, like the announcement we had yesterday and the big investment in Bedfordshire.”

She said the aim is also to continue to support key industries.

European shares surge after Trump’s tariff climbdown

European shares have surged after US President Donald Trump announced an immediate 90-day pause on reciprocal tariffs for most trading partners, prompting a massive relief rally after days-long market rout.

The pan-European STOXX 600 jumped 5.9 per cent at 07.52 GMT on Thursday, after losing 12.5 per cent since the tariffs took effect on 2 April up to last close. Trade-sensitive Germany’s benchmark index rose 6.7 per cent.

The suspension of punishing tariffs on dozens of countries came less than 24 hours after they kicked in. Still, the White House maintained a 10 per cent blanket duty on almost all US imports.

UK ministers still hopeful for economic deal with US to soften blow of Trump’s tariffs

UK ministers still hope an economic agreement with Washington can be reached to soften the blow of some of Donald Trump’s tariffs.

Chancellor Rachel Reeves will seek to negotiate with the US when she visits Washington at the end of April for the International Monetary Fund’s spring meeting of global finance ministers, she told the Financial Times.

She also said a UK-EU summit on May 19 would be a chance “to refresh our relationship and make it easier for businesses to trade”.