Inflation charges stay: Bank of England anticipated to carry rates of interest at 4.75 per cent

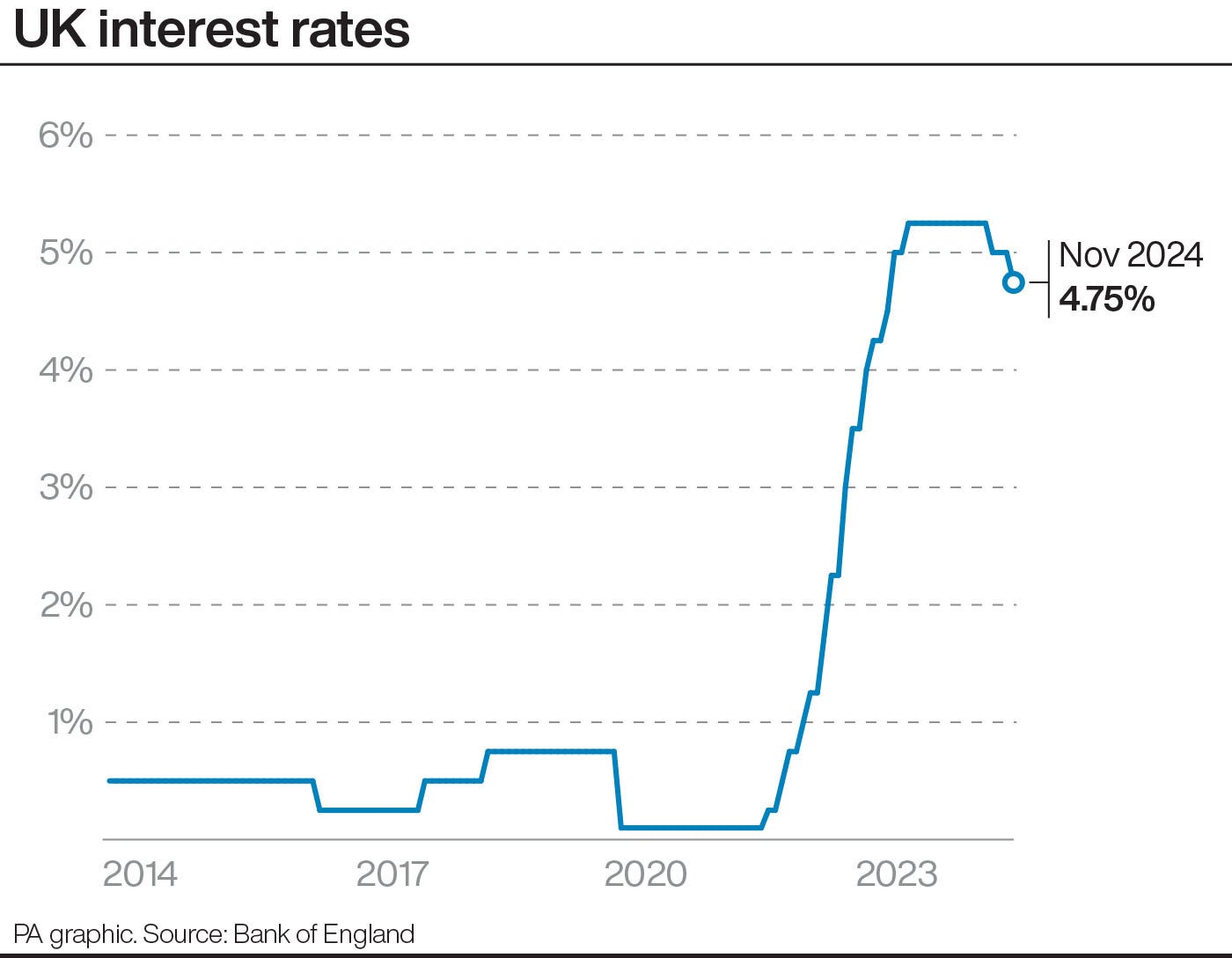

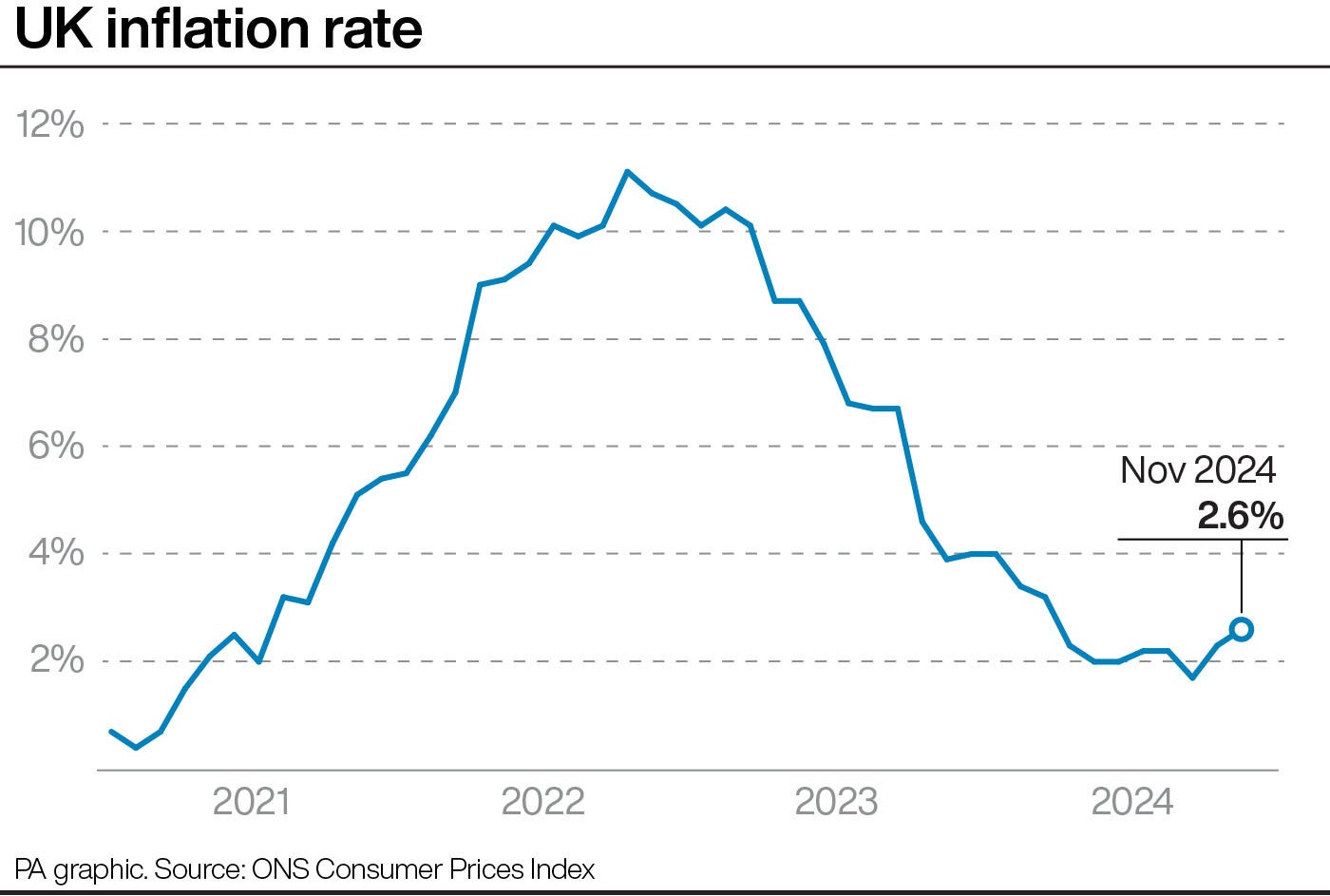

The Bank of England is expected to hold interest rates steady at 4.75 per cent on Thursday after it was revealed that inflation in November rose to 2.6 per cent, above the central bank’s target.

The Office for National Statistics revealed inflation had risen to 2.6 per cent from 2.3 per cent, pushed higher by pricier petrol and clothing.

The central bank uses higher interest rates as a tool to try and tame inflation, forcing families to spend more on borrowing rather than pushing up the prices of goods.

Another pressure on inflation comes from rising wages. Pay packets are now growing at 5.2 per cent, up from 4.9 per cent three months ago, according to data from the Office for National Statistics released earlier this week.

Money market traders have pushed back their expectation of a rate cut to May. Previous market activity suggested that a cut could have come in March.

Commercial lenders like high street banks and building societies use the bank base rate as a guide on how much to charge borrowers and how much to reward savers.

Chancellor Rachel Reeves said there is “more to do” to combat cost-of-living pressures.

“I know families are still struggling with the cost of living and today’s figures are a reminder that for too long the economy has not worked for working people,” she said on Wednesday.

“Since we arrived real wages have grown at their fastest in three years. That’s an extra £20-a-week after inflation.

“But I know there is more to do. I want working people to be better off which is what our Plan for Change will deliver.”

What went up and down in the inflation figures from yesterday?

The rate of CPI inflation for food and non-alcoholic drinks, alcohol and tobacco, clothing and footwear, recreation and culture all edged higher over the year to November, compared with the year to October.

It follows a hike to tobacco duties at the end of October.

Petrol prices also rose by 0.8p per litre between October and November to stand at 134.8p per litre, and diesel prices increased 1.4p per litre to 140.5p per litre.

Overall prices across the transport sector fell by 1.1 per cent in the year to November, but at a slower rate than the 2 per cent fall in the year to October, meaning it was the biggest factor pushing inflation higher last month.

In better news, air fares tumbled by 19.3 per cent in November, largely driven by falls in ticket prices on European routes, the Office for National Statistics said.

Just to hedge our bets ahead of the announcement, traders in the financial markets are expecting about a 10 per cent chance of a rate cut, Investec Economics said on Wednesday

Rob Wood, chief UK economist for Pantheon Macroeconomics, said: “Inflation rising above the MPC’s (Monetary Policy Committee’s) target is one reason why we expect rate-setters to cut interest rates gradually.”

Rate cuts next year are far more likely, assuming inflation is brought to heel.

Rates have been on a merry journey since the financial crisis, when borrowing was close to free for some debtors, including various governments.

The record high was 17 per cent in November 1979, which remained the rate until July 1980.

The record low was 0.1 per cent in March 2020 in the wake of Covid.

From 1719 to 1822 rates were fixed at 5 per cent.

What this means for mortgages

Sarah Coles, head of personal finance, Hargreaves Lansdown says:

“Mortgage rates have struggled to settle in recent weeks, with each piece of economic news – and each utterance from the Bank of England – sending rates slightly up or down within a fairly narrow range.

“Higher inflation is likely to mean another small fluctuation upwards in fixed rates, but given that rate expectations should remain largely unchanged, there’s every chance it’s nothing to write home about. We could see average 2-year fixed rates remain about the 5.5 per cent point.

“This is more bad news for buyers, faced with record-high prices and relatively high mortgage rates that show no sign of significant easing. The HL Savings & Resilience Barometer shows that people in their early 30s have the biggest sums outstanding on their mortgage – with 45% more mortgage debt than people in their early 50s – so they may be at most risk of being overstretched.

If you’re in the market for a remortgage, there’s no sign of imminent relief either. And with some uncertainties remaining about the trajectory of rates and inflation, it may be worth locking in a rate as soon as you can. That way if rates fall, you can shop around, and if they’re higher when your remortgage rolls around, you’ll have secured a better rate.”

Economics Expert, Professor Andrew Angus at Cranfield School of Management is also sceptical about any rate cut.

“A combination of increased public spending, infrastructure investments and the approaching winter is expected to drive inflation higher, making an interest rate cut this Thursday about as likely as a White Christmas.

“Despite predictions of economic growth, a palpable sense of uncertainty remains about how businesses will cope in the wake of the recent budget. Many are already feeling the pinch from rising costs, including higher business rates, increased minimum wages and National Insurance contributions, which may overwhelm many businesses. With an early Christmas present in the form of a rate cut off the cards and the next announcement not due until February, businesses will be eager to see how the Bank of England acts to promote stability and growth.”

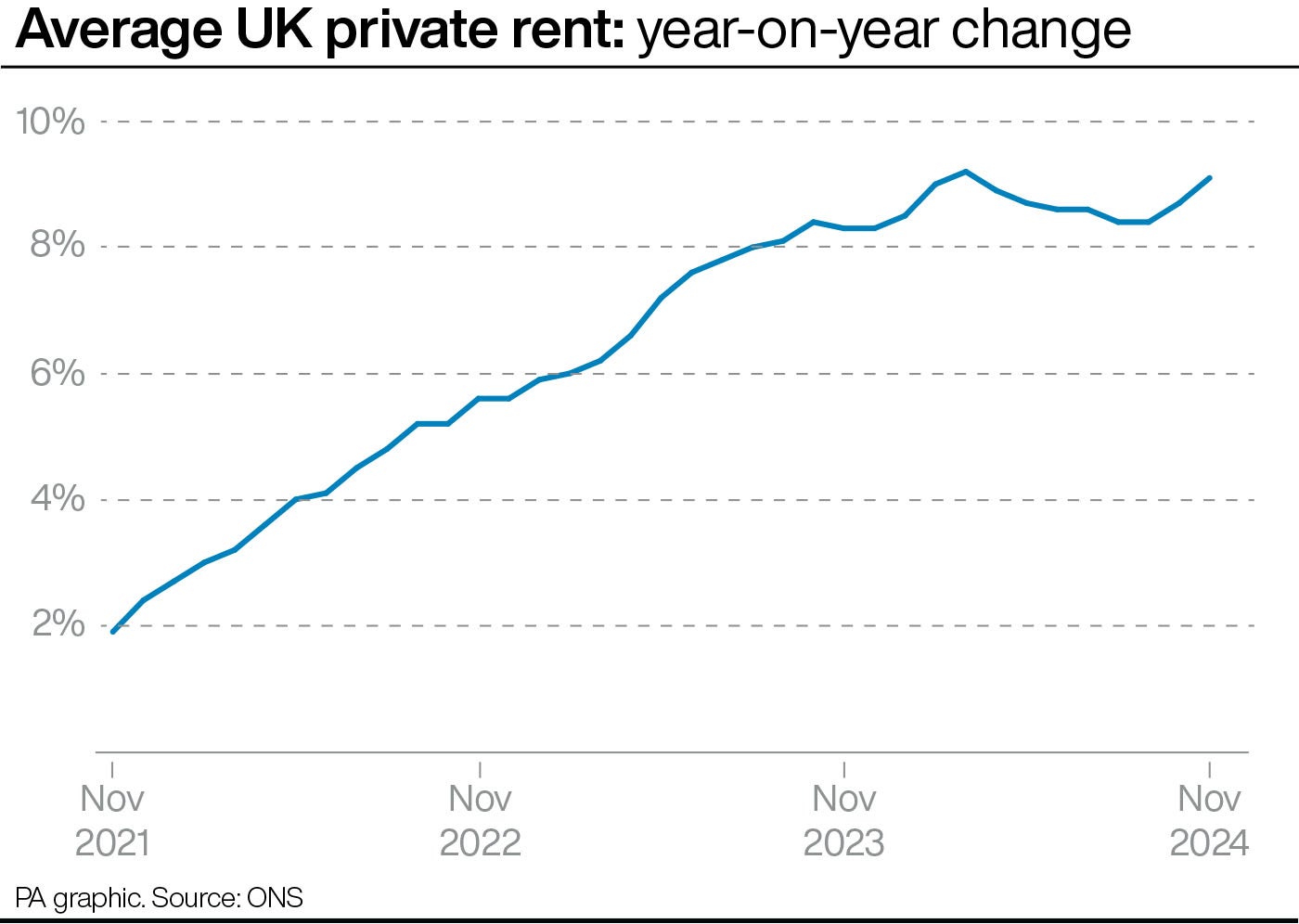

One thing CPI inflation does not capture is housing costs, which are also rising. Although this is more closely linked to supply.

Annual growth in UK house prices and rents has accelerated, with rental price inflation in England and London hitting record highs, according to official figures.

The average house price increased by 3.4% in the 12 months to October, ticking upwards from 2.8% in September, according to Office for National Statistics (ONS) data. The report also showed annual growth in private rental prices accelerated to 9.1% in November, from 8.7% in the 12 months to October.

ONS head of housing market indices Aimee North said: “Rental prices climbed again in the year to November with the average private rent in Great Britain now around £1,300 per month.

Higher inflation should be seen in the broader context – under 3 per cent is way below the recent highs we have seen.

Most economists expect some relief for borrowers next year. The current rate of 4.75 per cent is only slightly lower than the 5.25 per cent that rates topped out at following the inflation shock the UK suffered.

Monica George Michail, National Institute of Economic and Social Research Associate Economist said: “We expect the MPC to keep rates on hold in tomorrow’s meeting, and to gradually cut rates in 2025.

“However, we think the Bank will remain cautious given elevated wage growth, global uncertainty around the Trump presidency, and inflationary pressures introduced in the latest budget. Interest rates may therefore remain higher for longer than previously thought.”

New figures out today will also add to the feeling of gloom. Manufacturing output volumes fell at the fastest pace since mid-2020, according to the Confederation of British Industry, the business lobby group.

Production of cars, glass, ceramics, furniture and upholstery led the fall, the CBI said.

Its survey of 331 manufacturers said output fell by 25 per cent ni the three months to December.

Ben Jones, CBI Lead Economist, said: “Manufacturers are facing a perfect storm of weakening external demand on the one hand, amid political instability in some key European markets and uncertainty over US trade policy. And on the other hand, domestic business confidence has collapsed in the wake of the Budget, which has increased costs and led to widespread reports of project cancellations and falling orders.”